| Mortgage Loan Programs

Types of Home Loan Programs

From buying your dream home to accessing home equity, we have the mortgage loans to achieve your goals.

CONVENTIONAL

I have a strong credit score and steady income, and I want a competitive loan option.

Lower interest rates with good credit

Reduced or cancelable mortgage insurance

Flexible loan terms and options

SELF-EMPLOYED

I am self-employed or a business owner and my tax returns don’t reflect my true income.

Qualify using 12–24 months of bank statements

No tax returns, W-2s, or pay stubs required

Options for 1099 earners and business owners

VA

I am a Veteran or Active Duty service member and want to use my VA benefits.

No down payment required

No monthly mortgage insurance

Competitive interest rates

DSCR

Debt Service Coverage Ratio

I want to qualify using rental income instead of personal income

Qualify using rental income

No personal income verification

Ideal for real estate investors

FHA

I want easier credit requirements and more flexible qualification guidelines.

Lower credit score requirements

Smaller down payment options

Flexible income and debt guidelines

USDA

I want to live in a rural or suburban area and need affordable financing.

No down payment required

Low monthly mortgage insurance

Competitive interest rates

REVERSE

I am 62 or older and want to use my home equity for retirement cash flow.

No monthly mortgage payments required*

Possibly access home equity as tax-free cash

Stay in your home while maintaining ownership

*Must still pay critical property charges like taxes and insurance

REFINANCE

I want to improve my current mortgage to better fit my financial goals.

Lower payments or better terms

Access home equity if needed

Simplify or restructure debt

JUMBO

I need a larger loan amount than standard county limits allow.

Higher loan limits for luxury homes

Competitive rates for well-qualified buyers

Flexible property options

MORTGAGE CALCULATOR

MID FLORIDA MORTGAGE BLOG

Appraisal Changes in 2026 Affecting Home Values

The housing market keeps evolving — and just when you think the changes are over, here comes another big one. New appraisal rules are coming, major institutions are weighing in on home values, and the... ...more

Florida Real Estate Market

January 27, 2026•2 min read

WHAT OUR CLIENTS SAY

Our clients are at the center of everything we do. Their experiences reflect our dedication to clear guidance, trusted mortgage expertise, and a home-financing experience built around care and understanding.

Contact Info

We’re here to make your home financing experience smooth and stress-free. Contact our team anytime — we’re ready to guide you through every step of your homebuying journey.

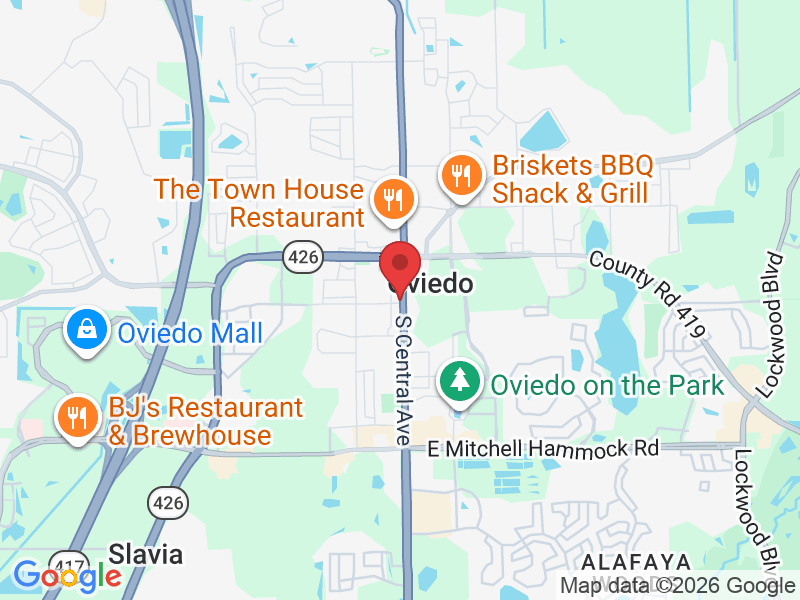

Location

235 S Central Ave, Oviedo Florida 32765

Phone

Mid Florida Mortgage Professionals

Company NMLS# 1587074

Rayce Robinson

LO NMLS # 322615

235 South Central Ave

Oviedo, Florida 32765

© 2026 Mid Florida Mortgage Professionals. All rights reserved. Mid Florida Mortgage Professionals is not affiliated with any government agencies. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. NMLS Consumer Access